M-PESA runs on certainty. For years, a familiar ping has been the seal on every transaction: money sent, money received, deal done. This week, that rhythm faltered. Customers transferred funds five, six times without a single confirmation. The money moved and sometimes didn’t, but the silence left people guessing.

At first glance, an SMS delay may sound minor. The money still lands. Balances still update. But in a country where cash has gone digital, the confirmation text isn’t just information — it’s reassurance. Without it, customers hesitate. Shopkeepers refuse to hand over goods. Agents second-guess their tills. And small traders — who run on speed and trust — find themselves stranded in awkward standoffs.

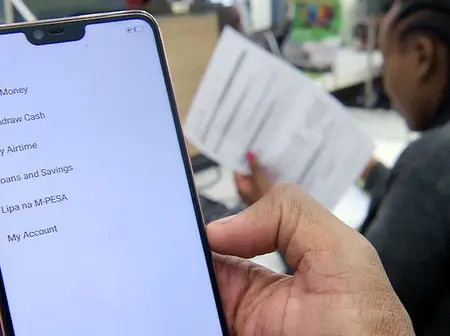

Safaricom admitted the problem and apologized, noting that teams are working on a fix. In the meantime, the USSD code *334# has become the fallback. Dial it, and you can see your balance or recent transactions. It’s functional, but it feels like a step back in a system built on instant feedback.

The hiccup comes against a backdrop of Safaricom’s massive upgrade of the M-PESA platform. Engineers are retooling the system to handle 8,000 transactions per second by 2026, double today’s ceiling. At present, M-PESA processes more than 125 billion transactions a year, humming at about 300 transactions a second even in the dead of night.

To support that scale, Safaricom is shifting M-PESA into a fully cloud-native, active-active architecture. That means if one environment fails, traffic can switch to another in minutes, often before users notice. More than 700 servers now run the system across multiple sites. In theory, this is a platform built to never sleep.

Yet the SMS delays show the fragility in the edges of the ecosystem. The core money rails remain strong. The weak link is the feedback loop. And in digital finance, silence can feel as damaging as downtime.

Reliability is not just about uptime. It’s about confidence. For M-PESA, where a single minute of outage could disrupt 240,000 requests, consistency is the currency that underpins the entire economy. A shopkeeper waiting for a message doesn’t care about cloud-native architectures. They care about knowing when it’s safe to hand over bread, fuel, or fare.

The SMS disruption is temporary, but it’s a reminder that the system must be judged not only on scale but also on user experience. As M-PESA grows into a continent-spanning financial ecosystem — powering loans, remittances, savings, and payments — even small cracks in communication can feel seismic.

For now, the fallback remains old-school: dial *334# and confirm. But in the long run, Safaricom’s bet is clear. The M-PESA of tomorrow will need to be faster, more resilient, and far less reliant on something as fragile as a text message.

Leave a Reply