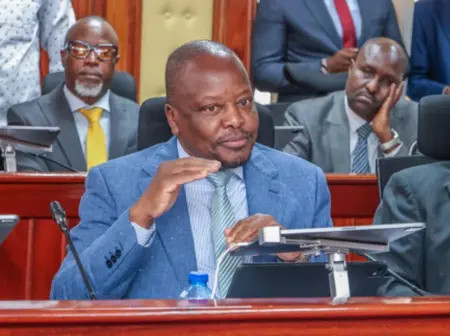

Agriculture Cabinet Secretary (CS) Mutahi Kagwe on Thursday explained why millers and importers will be paying a 4% sugar development levy.

Appearing before the Senate Committee on Delegated Legislation, Kagwe said that the levy was prompted by a need for the sugar sector’s expansion, the push for quality-based cane payment, and renewed investment in research demand.

“Maintaining the rate at 4% is not about burdening the industry, but about aligning resources to the scale and scope of today’s challenges and opportunities,” Kagwe said.

Kagwe further intimated that various stakeholders had earlier proposed a reduction of the levy to as low as 1% while others wanted an increment to 10%.

He said most settled at 4% and the ministry settled with the rates gazetted and implemented under Section 40(1) of the Sugar Act, 2024, effective July 1, 2025.

The Agriculture Ministry boss stated that the Kenya Sugar Research and Training Institute (KESRETI) had its mandate broadened under the new Act to include also training, a development that requires heavy investment in curriculum and infrastructure.

“The 4% levy ensures adequate and sustainable financing to meet these expanded obligations,” he said.

The CS also emphasized that the levy rate was deliberated after an extensive public participation and a Regulatory Impact Assessment.

The Sugar Act, 2024, distinguishes the base of assessment depending on the source. Local millers will pay the levy based on the ex-factory price while importers will pay based on the CIF value of each consignment.

It will be collected by the Kenya Revenue Authority (KRA) and earmarked for the Sugar Development Fund.

The Senate Committee is now expected to weigh the Ministry’s submissions alongside stakeholder concerns before issuing its decision on whether the levy will stand at 4% or be revised.

Leave a Reply