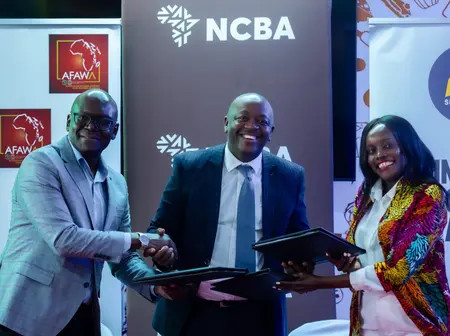

A new chapter for women-led enterprises in Kenya’s agri-food sector began this week as NCBA, alongside the African Guarantee Fund (AGF), AFAWA, Unga Group, and SME Support Centre, launched the NCBA–AFAWA WSMEs Acceleration Program.

The initiative has welcomed 38 businesswomen from the agri-food supply chain, human food production, and animal feed industries into its first cohort.

Spanning one year, the initiative is designed to transcend the traditional model of financial support by integrating mentorship, market access, and practical skills development, creating an environment in which these entrepreneurs can not only access funding but also translate it into sustainable business growth.

By the conclusion of this programme in July 2026, organisers anticipate that 80 women entrepreneurs will have benefited, with Sh647.45 million in financing mobilised and at least 300 jobs generated, marking a notable contribution to Kenya’s economic landscape.

Dennis Njau, NCBA’s Group Director of Retail Banking, reflected on the deeper rationale behind the initiative, highlighting the importance of guidance and structured support alongside capital injections.

“Our partnership with AGF has successfully granted close to Sh17 billion in loans. However, we realised that these entrepreneurs needed mentorship, advanced training, and access to markets to fully thrive. This approach will enable their businesses to achieve sustainable growth,” Njau stated.

Njau further elaborated on how the programme fits into NCBA’s broader mission of empowering women entrepreneurs, emphasising that the initiative is designed to combine financial support with practical tools and guidance for sustainable business growth.

“The partnership is a clear demonstration of our customer-centric retail banking strategy in motion, anchored on enabling productivity, deepening access to credit, technical assistance and capacity building; and building solutions around what truly matters to our customers,” he added.

“We are pleased to roll out this initiative, with like-minded partners such as AGF, Unga Group and SSC, as it enhances our lending and capacity building programmes for SMEs, particularly those owned by women and young entrepreneurs.”

Earlier this year, the bank doubled its lending capacity for women and youth entrepreneurs from Sh1.5 billion to Sh3 billion.

To date, NCBA has issued almost Sh17 billion under AGF’s risk-sharing framework, impacting 700 SMEs and supporting over 7,000 jobs, including 2,200 for women.

Patrick Lumumba, AGF’s Group Director of Capacity Development, emphasised the programme’s holistic approach, explaining that it goes beyond financing to provide mentorship, credit facilitation, and access to markets, all aimed at nurturing sustainable growth for women entrepreneurs.

“Through AFAWA, we’re trying to not only de-risk women-owned businesses but also give them access to credit, mentorship and market opportunities they need to grow. Our partnership with NCBA, Unga, and SSC is an example of that commitment in action,” Lumumba remarked.

Unga Group, acting as the programme’s learning partner, will expose participants to industry practices and scaling models, while the SME Support Centre will lead coaching, training, and mentorship.

James Nyutu, CEO of Unga Group, described the programme as an opportunity to empower individual entrepreneurs while simultaneously strengthening Kenya’s agri-food ecosystem.

James Nyutu, CEO of Unga Group, described the programme as an opportunity to empower individual entrepreneurs while simultaneously strengthening Kenya’s agri-food ecosystem.

“We are excited to welcome these ambitious entrepreneurs through our doors. At Unga Group, we believe that sustainable transformation in the agri-food sector starts with empowering those at its core, our farmers, processors, and innovators. By sharing our heritage, technical expertise, and commitment to responsible production, we aim to inspire these women to scale their businesses with resilience and purpose,” Nyutu said.

He continued by emphasising the long-term impact the programme is expected to have on the wider agri-food landscape.

“Through this partnership, we are not only supporting individual entrepreneurs but also strengthening the agri-food ecosystem in alignment with our long-term sustainability goals. Together with our partners, we are cultivating a future where women-led enterprises are central to building food security, inclusive growth, and a more sustainable Kenya,” he emphasised.

Linda Onyango, CEO of SME Support Centre, outlined the programme’s immersive methodology, explaining that participants will benefit from a combination of classroom learning, practical exposure, and direct business assessments, ensuring a comprehensive development experience

“This one-of-a-kind acceleration program is designed to support the women-owned enterprises to access skills, markets and finance through an integrated approach,” Onyango said.

She then described the programme’s immersive training methodology, outlining how participants will experience both classroom and hands-on learning, as well as direct engagement with their own businesses to ensure practical application of the skills acquired.

“The SME Support Centre is adopting a wholistic training and capacity building approach combining classroom training with practical factory visits to Unga Group, onsite capacity assessment visits to the WSMEs premises and financial linkages with NCBA for an all-rounded business transformation experience.”

The launch represents a firm step towards a more inclusive business environment in Kenya, placing women entrepreneurs at the heart of economic growth while fostering a resilient and sustainable agri-food sector.

Leave a Reply