Category: Economy&Finance

-

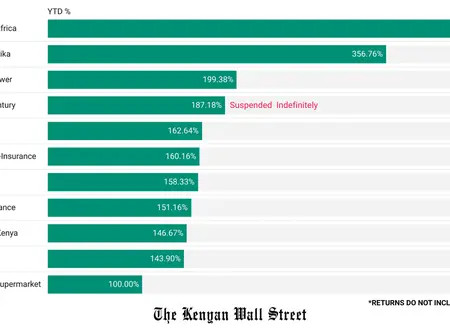

Foreign investors accelerated their exit from the Nairobi Securities Exchange (NSE) in the second week of September even as the market delivered its strongest rally in more than a decade. Selling has been concentrated in large caps. Safaricom accounted for over half of foreign sales in Week 1 and remained dominant in Week 2. Banks…

-

Kenya’s banking sector has surpassed its annual commitment to lend KShs 150 billion to micro, small, and medium enterprises (MSMEs), disbursing KSh 153 billion so far this year, according to the Kenya Bankers Association (KBA). ” As we configure survival, we must integrate opportunities in nature finance to sustain growth and contribute to the global…

-

Sanlam Kenya Plc has called an extraordinary general meeting (EGM) for 9 October 2025 to seek shareholder approval to change its name to Sanlam Allianz Holdings (Kenya) Plc. In 2022, Allianz formed a pan-African joint venture with Sanlam, launching SanlamAllianz in September 2023 with a group equity value of R35 billion ($2 billion) split 60%…

-

Kenyan shipments to Kigali fell sharply in the second quarter of 2025, according to the National Institute of Statistics of Rwanda (NISR), with the value of imported goods between April and June dropping to US$ 78.2 million from US$ 245.1 million a year earlier; a decline of more than 68%. “In the second quarter of…

-

high voltage pylon. Transportation of high voltage electricity Kenya’s new draft energy regulations would compel electricity providers to compensate consumers for outages and poor-quality supply, imposing fines for missed reports, inadequate outage notices, and technical failures. Industrial consumers stand to receive compensation amounts running into hundreds of thousands of shillings per event, calculated under a…

-

The National Treasury has redeemed the 12-year tax-free infrastructure bond IFB1/2013/12, settling KSh 15.2 billion on its 15 September 2025 maturity date. This marks the third major bond redemption in the last 6 months, following: Together, these redemptions have eased part of the government’s domestic debt stock, although at a heavy interest cost due to…

-

Ever wondered what it means when you hear a company has been placed under administration? Section 522(1): The objectives of the administration of a company are:(a) to maintain the company as a going concern; (b) to achieve a better outcome for the company’s creditors as a whole than would be the case if the company…

-

The Central Bank of Kenya (CBK) has raised KSh 61.44 billion from the reopening of two long-dated Treasury bonds, reversing a weak start to its September bond sale programme. Both cleared below their market-weighted average rates of 13.72% and 14.25%, showing strong investor demand for long-dated government debt. Metric FXD1/2018/020 (20-year) FXD1/2022/025 (25-year) Bids Received…

-

Kenya’s rail transport got a lift after President William Ruto unveiled the Mombasa Commuter Rail Service, a city–SGR link expected to ease congestion and boost trade. “Efficient, safe, and sustainable transport is the backbone of a strong economy. By shifting more passengers from road to rail, we lower costs, cut emissions, and make our transport…

-

County governments raised KSh 67.30 billion from own-source revenue (OSR) in the 2024/25 financial year, a 62.6 percent jump from KSh 41.40 billion in the previous year. Nairobi City led in nominal collections with KSh 13.19 billion, followed by Mombasa (KSh 5.13B), Narok (KSh 5.67B), Kiambu (KSh 5.06B) and Nakuru (KSh 3.65B). At the bottom…