Category: Economy&Finance

-

The Energy and Petroleum Regulatory Authority (EPRA) has issued its latest monthly review of fuel prices, bringing slight relief to Kenyan motorists and households with a reduction in the cost of super petrol and kerosene. The new prices, announced on Thursday, August 14, will take effect from midnight, August 15, 2025, and remain in force…

-

Safaricom Business, the enterprise arm of Safaricom PLC, is steadily cementing its position as a key driver of Kenya’s digital transformation. Tasked with designing and delivering innovative products and services for organisations ranging from small startups and mid-sized firms to large corporates and government institutions, the division is evolving into a full-scale business technology partner.…

-

Old Mutual has partnered with the Kenya Bodaboda Association (KBA), Rescue.Co, Incourage Insurance, and Rafiki Microfinance Bank, to set up the Boda Riders Super Cover, a new solution that offers hospitalisation and last expense support to boda boda riders. The cover is designed to provide boda boda riders and owners with financial support during hospitalisation…

-

The National Youth Opportunities Towards Advancement (NYOTA) Project, a KES 20 billion World Bank-backed program, is set to roll out soon, bringing skills, capital, and financial inclusion to the country’s most vulnerable youth. President William Ruto officially announced the project during his 2025 Madaraka Day address, positioning NYOTA as a flagship under the Bottom-Up Economic…

-

From August 15 to November 15, Kenyans can take part in the Funua Flava Under the Crown promotion for a chance to win daily and weekly cash prizes, including a grand weekly prize of Ksh 1,000,000. The nationwide promotion, run by Coca-Cola Beverages Africa (CCBA) in Kenya, will reward consumers with cash, airtime, and data…

-

Absa Bank Kenya PLC has announced an enhancement of its Shariah-compliant banking offering through the launch of La Riba Sultanah – Kenya’s first Shariah-compliant account designed to empower women entrepreneurs with financial independence and business growth. This marks a significant milestone in Absa’s strategic commitment, aligning with its sustainability pillar that seeks to deepen financial…

-

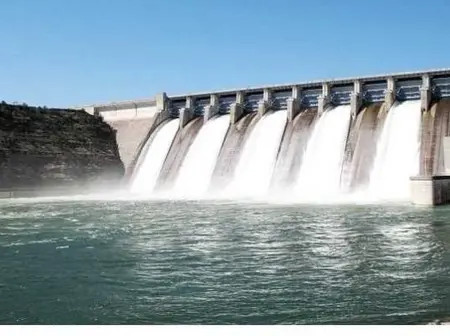

Kenya has secured a significant Ksh8.3 billion loan to redevelop the ageing Gogo Hydro Power Plant in Migori County in a renewed push to strengthen energy security and reduce reliance on expensive thermal generation. The financing agreement was signed with a consortium of international lenders and will go towards upgrading the plant’s installed capacity, modernising…

-

The Social Health Authority (SHA) has closed all its regional and sub-county offices nationwide, relocating staff to county headquarters and the national office in Nairobi as part of a sweeping institutional reform. The decision, which affects offices largely inherited from the defunct National Health Insurance Fund (NHIF), is aimed at streamlining operations, cutting administrative costs,…

-

KCB Group has opened high level negotiations to acquire a forty percent stake in one of Ethiopia’s domestic banks as part of its aggressive regional expansion strategy targeting fast growing East African economies. The Nairobi based lender is eyeing entry into Ethiopia’s lucrative financial market after the government in Addis Ababa recently allowed foreign ownership…

-

The National Treasury is staring at a fresh confrontation with county governments after failing to disburse the constitutionally mandated monthly cash allocations for July, raising fears of a crippling cash crunch at the devolved units. The delayed transfers have sparked alarm among governors who say they are unable to pay workers, meet essential service obligations…