The government is exploring ways to align levies imposed by counties on transit goods with the East African Community’s (EAC) Common External Tariff (CET), amid growing concern over country-specific tax remissions that officials warn are undermining the customs union and eroding progress in boosting intra-regional trade.

EAC Cabinet Secretary Beatrice Askul said varying charges on similar goods across partner states give selective cost advantages, tilting competition in the common market and discouraging regional investment in targeted value chains.

She called for product differentiation and unique innovation to boost intra-EAC trade and competitiveness, and urged EAC Partner States to remain committed to agreed EAC obligations.

“The EAC’s 300 million citizens present a vast market, and adopting digital solutions within the Single Customs Territory will further facilitate trade,” she said.

The CET is currently structured as a four-band tariff schedule with a top rate of 35 percent, adopted in 2022, covering textiles, steel, plastics, paper, and leather to support manufacturing within the region.

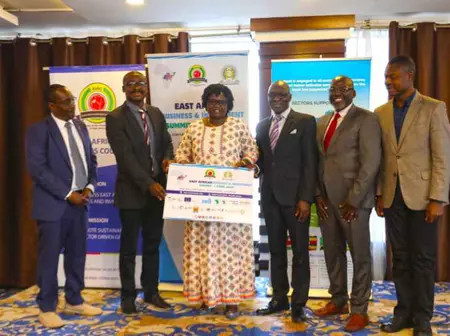

CS Moe made the remarks in Nairobi during the EABC CEO–EAC Secretariat Consultative Meeting, where she also unveiled the East African Business and Investment Summit & Expo 2025, set for October 16-17 in Nairobi.

EABC Vice Chairperson and KEPSA Chair Jas Bedi warned that shifting global trade patterns require a unified East African approach.

“We must think differently as East Africa. We need to act as ‘Team East Africa.’ East Africans must adapt faster than the rest of the world and seize opportunities collectively. Global dynamics are shifting, in the next 45 days, AGOA will expire, and the world is moving from multilateral agreements to transactional bilateral agreements. We must know our competitors as East Africa and negotiate for better tariff terms,” he said.

His sentiments were echoed by EABC Acting Executive Director Adrian Raphael Njau who noted that intra-EAC trade remains at 9.3 percent, urging partner states to fully implement the Single Customs Territory framework, harmonize taxes, and remove discriminatory fiscal measures on goods originating within the bloc.

The two-day meeting brought together 55 representatives from Kenya’s public and private sectors to discuss solutions to trade and investment barriers, ahead of the October summit that will focus on sectoral challenges in agriculture, manufacturing, tourism, financial services, and logistics.

Leave a Reply