Kenya and Belgium on Tuesday signed an Agreement for the Avoidance of Double Taxation (DTA) at the National Treasury in Nairobi, establishing a tax framework designed to eliminate double taxation on cross-border income and tighten safeguards against tax evasion.

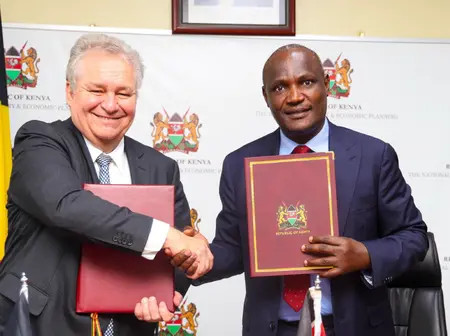

National Treasury Cabinet Secretary John Mbadi signed the pact on behalf of Kenya, while Belgium’s Ambassador to Kenya, Peter Maddens, represented the Kingdom of Belgium.

Mbadi explained that the agreement is intended to make taxation more predictable and fair while also encouraging new trade and investment between the two nations.

He added that it builds upon the ongoing diplomatic engagements between Nairobi and Brussels.

“This signing builds on the momentum of the 2024 Kenya-Belgium Political Consultations in Brussels, during which both countries reaffirmed their commitment to broaden cooperation in trade and investment,” Mbadi affirmed.

The Cabinet Secretary went further to outline Kenya’s economic resilience, noting that the country’s nominal GDP in 2024 stood at USD 121.3 billion, which is roughly Sh15.7 trillion at current exchange rates.

He attributed this strength to sound macroeconomic management, a diversified production base, and a dynamic services sector, while also pointing to Kenya’s regional position and skilled workforce as significant draws for investors targeting Sub-Saharan Africa.

Maddens, in his remarks, described the signing as a milestone that strengthens both diplomatic and economic ties between the two countries.

He said Belgium regards Kenya as a strong investment partner on the continent, with attractive opportunities in manufacturing, ICT, renewable energy, and horticulture.

With the DTA now in place, policymakers expect greater investor confidence, stronger economic cooperation, and new trade opportunities between Kenya and Belgium.

Leave a Reply