United Bank for Africa (UBA) has committed $150 million, about Ksh 16.38 billion, to Kenya’s Road Maintenance Levy securitisation programme, giving a major boost to the government’s plan to accelerate road development.

The initiative, managed by the Kenya Roads Board (KRB), is designed to raise $1.35 billion (Ksh 175 billion) by securitising a portion of the Road Maintenance Levy Fund.

The programme allows the government to leverage predictable future income from the levy by bundling a share of those collections and selling them to investors through a Special Purpose Vehicle.

The goal is to provide upfront capital that can be used to pay contractors, speed up stalled projects, and reduce pressure on the exchequer.

UBA Kenya, a subsidiary of the UBA Group, is providing a bridge facility that positions it among the largest financiers of the deal.

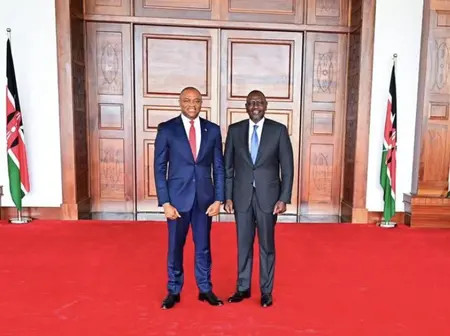

“Our USD 150 million commitment to the Roads Levy Securitisation Program reflects our confidence in Kenya’s future and our belief in infrastructure as a foundation for trade, competitiveness and inclusive prosperity. This transaction is a demonstration of UBA’s ability to be a partner for infrastructure projects,” UBA Group Managing Director Oliver Alawuba said.

UBA Kenya CEO Mary Mulili noted that the bank is keen on establishing itself as a trusted partner in infrastructure, trade, and inclusive finance.

She emphasised that UBA’s strategy is to support Kenya’s development agenda by playing a stronger role in mobilising capital for transformative projects.

The Ministry of Roads and Transport welcomed UBA’s participation, describing it as a sign of investor confidence in the country’s infrastructure programme and evidence of the role Pan-African banks can play in financing development.

KRB became the first public infrastructure agency in Kenya to apply this model by securitising part of its income from the Road Maintenance Levy Fund. Currently, Ksh12 out of every Ksh 25 per litre of fuel collected will be directed toward the programme over the next ten years.

The commitment was handed over to a Special Purpose Vehicle, which raised Ksh 175 billion upfront from private investors.

The move comes at a time when Kenya faces a significant backlog of road projects, with more than 500 stalled works due to delayed payments.

By unlocking new funding through securitisation, KRB has begun settling outstanding bills and reviving projects nationwide.

Officials say the model does not impose new taxes or additional borrowing, but instead restructures existing revenue streams to make money available more quickly.

The success of this programme is expected to improve road networks, cut transport costs, and boost trade and connectivity, particularly in rural areas.

Leave a Reply