Foreign investors accelerated their exit from the Nairobi Securities Exchange (NSE) in the second week of September even as the market delivered its strongest rally in more than a decade.

Selling has been concentrated in large caps. Safaricom accounted for over half of foreign sales in Week 1 and remained dominant in Week 2. Banks including Equity, KCB, and DTB have also seen heavy churn.

Local investors have sustained strong buying, pushing the NSE 20 Share Index up 50.1% year-to-date, its best performance since 2003 (+101.5%).

The NSE All Share Index is up 44.7% — its best year since its 2008 inception, the NSE 10 has gained 36.4%, and the NSE 25 has climbed 36.0%, while market capitalization has expanded from KSh 1.94 trillion to KSh 2.82 trillion in 2025.

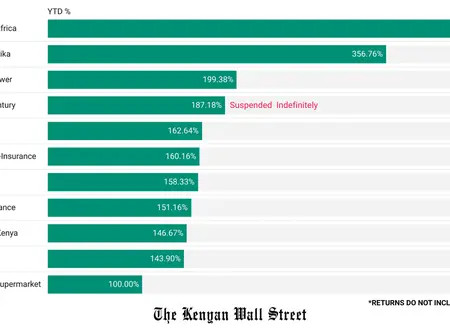

A record 11 NSE stocks have each more than doubled in 2025, highlighting the rally’s breadth.Sameer Africa leads with 480%, followed by Home Afrika at 357% and Kenya Power at 199% (also up 914% since January 2024)

Only five stocks remain negative:

Leave a Reply