Kenya is experiencing a significant rise in fraud, both online and offline. From cyberattacks targeting critical systems to fake agents and mobile phone scams, fraudsters are exploiting every vulnerability to steal money and sensitive information.

A recent report, the Cyber Shujaa Industry Report 2025, revealed that Kenya recorded 2.5 billion cyberattacks between January and March 2025. Criminals are exploiting weak passwords, outdated software, and insecure networks to breach systems.

At the same time, mobile phone scams are becoming increasingly common. According to a World Bank survey, nearly half of Kenyan mobile phone users recently received fraudulent calls or text messages disguised as urgent financial requests, prize claims, or official government notices. While 51 percent of victims avoided sending money, the growing sophistication of these scams highlights the need for heightened vigilance.

Amid this surge in digital fraud, physical scams like agency fraud are also on the rise. Fraudsters posing as bank agents are targeting families and individuals, exploiting their trust to steal money. Protecting yourself from such scams requires awareness and the ability to identify genuine agents.

Jane, a small business owner in Nairobi, was rushing to deposit cash at what she thought was a bank agent outlet. However, the kiosk lacked the familiar bank agent branding, no official colors, logos, or signage. When Jane asked for the Certificate of Accreditation, the fake agent gave vague excuses. The required information poster, which should display the agent number and customer service contact, was also missing.

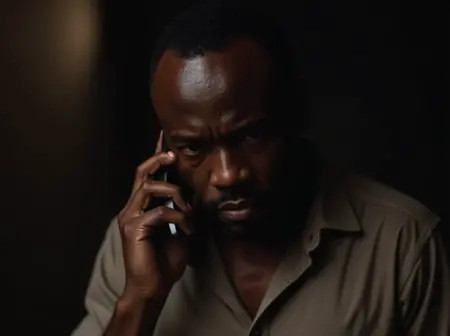

Feeling uneasy, Jane decided to call the bank’s customer service hotline. After providing the agent’s details, she was informed that the outlet was not registered with the bank. Jane’s quick thinking and decision to verify saved her from losing her hard-earned money to a fraudster.

Like Jane, you can protect yourself by ensuring you’re transacting with an authorized bank agent. Here’s what to look out for: for example, Equity Bank agents are branded as follows:

Equity Bank is committed to safeguarding its customers. Follow these tips to stay safe:

Be Vigilant: Fraudsters are constantly evolving their tactics, but you can stay one step ahead by verifying agents and following these security measures. For more tips on secure banking, visit: Secure Banking Tips | Equity Bank Kenya.

Leave a Reply