Kenyans who save and borrow through Saccos are reeling after their employers failed to remit Ksh 4.2 billion in deductions last year, leaving thousands at risk of loan defaults and damaged credit scores.

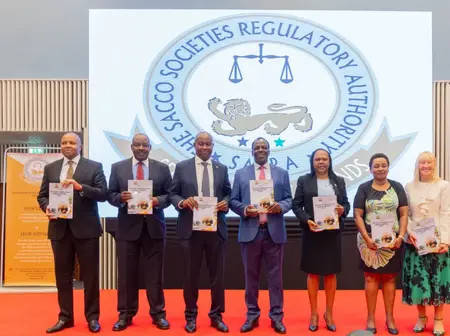

In its Sacco Supervision report released on Wednesday, September 25, the Sacco Societies Regulatory Authority (SASRA) said the crisis affected 85 regulated Saccos, comprising 62 Deposit-Taking Saccos and 23 Non-Withdrawable Deposit-Taking Saccos.

A total of 55,602 members were affected, comprising 49,821 from Deposit-Taking SACCOs and 5,781 from Non-Withdrawable Deposit-Taking SACCOs.

The report shows that the bulk of the missing money, about Ksh 3.10 billion or 74.5 per cent of the total, was meant to repay loans and credit facilities taken by Sacco members.

Without these remittances, the loans remain largely unpaid, weakening the liquidity of Saccos and their ability to meet financial obligations.

“Such non-remittances of loan repayment due have also led to conflicts between the Saccos affected and their members, such as contested listings in the Credit Reference Bureaus (CRBs), qualification for additional loans by the members, among others,’’ the report reads in part.

The crisis is largely driven by public institutions that deducted funds from employees’ salaries but failed to forward them to Saccos. County governments and assemblies owe Ksh 1.61 billion, representing 46.1 per cent of the total debt. Public universities and tertiary colleges failed to remit ksh 762.27 million, or 21.9 per cent, while state corporations owe Ksh 164.76 million, about 4.72 per cent of the total.

The Sacco Societies Regulatory Authority (Sasra) is now calling for urgent policy reforms to enable recovery of such amounts directly from exchequer grants released by the National Treasury to the defaulting institutions.

The non-remittance problem has worsened in recent years, rising from Ksh 2.6 billion in 2023 to Ksh 4.2 billion in 2024.

Financial analysts warn that unless tougher measures are introduced, the situation could further destabilise the Sacco sector, which millions of Kenyans depend on for credit and savings.

Despite the challenges, Saccos remain a vital pillar of the economy, contributing 6.63 per cent to Kenya’s Gross Domestic Product (GDP), up from 5.6 per cent a decade ago.

Their total assets have more than tripled in the past ten years, crossing the Ksh 1 trillion mark for the first time to reach ksh 1.076 trillion in 2024, up from Ksh 301.54 billion in 2014.

Membership has also more than doubled, rising to 7.39 million members in 2024 from just under 3.08 million in 2014, while total savings and deposits have tripled to ksh 749.43 billion in 2024 from Ksh 205.97 billion in 2014, underscoring the growing trust in Saccos as socio-economic investment vehicles.

Deposit-Taking Saccos, which dominate the industry by controlling over 80 per cent of its assets, deposits and loans, have strengthened their financial standing.

Their key capital-to-total assets ratio rose to 17.28 per cent in 2024, above the required minimum of 10 per cent and up from 16.07 per cent in 2023.

Institutional capital-to-total assets ratio also improved to 11.97 per cent in 2024, exceeding the minimum requirement of eight per cent and up from 9.1 per cent in 2023.

Non-Withdrawable Deposit-Taking Saccos posted similar gains, with their core capital-to-total assets ratio improving to 10.9 per cent in 2024, above the required eight per cent and up from 10.4 per cent in 2023.

Their core capital-to-total deposits ratio also increased to 14.3 per cent in 2024, compared to 13.5 per cent in 2023, well above the required minimum of five per cent.

The quality of loans in the Sacco sector improved, with 86.71 per cent of loans performing as agreed in 2024, up from 86.33 per cent in 2023. Loans in the watch category, overdue by one to 30 days, fell to 4.9 per cent in 2024 from 5.2 per cent in 2023.

The report highlights the paradox of a growing and resilient Sacco sector being held back by employers’ failure to remit members’ contributions.

For thousands of Sacco members who find themselves listed by CRBs or unable to access further loans despite faithfully paying their dues, the crisis is more than numbers on paper; it is a direct blow to their livelihoods and financial stability

Leave a Reply