A dramatic boardroom clash at Directline Assurance unfolded Monday as media mogul Samuel Kamau (SK) Macharia stormed the company’s Nairobi headquarters, sacked top executives, and installed his own team—despite a standing High Court order barring him from such actions.

The surprise takeover bid has escalated tensions between Mr Macharia, who claims control of the insurer via Royal Credit Limited, and the Insurance Regulatory Authority (IRA), which has closely monitored Directline’s protracted leadership crisis.

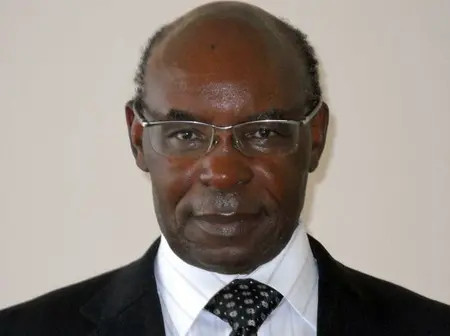

The latest twist saw Mr Macharia dismiss chief executive Sammy Kanyi, the head of finance, and several other senior managers. In their place, he named Wilson Wambugu Maina as acting CEO, Stella Kinoti as chief finance officer, Elizabeth Kuria as her deputy, and James Mari as ICT manager.

The company’s leadership, boardroom, and staff are now bitterly divided, raising fresh concerns for thousands of PSV (public service vehicle) operators and passengers relying on the insurer.

Directline collected Sh1.27 billion in premiums in the first half of 2025 but posted a Sh1.4 billion net loss, having settled Sh1.55 billion in claims during the same period, according to IRA records.

In response to the takeover, Kanyi condemned the move, highlighting the blatant disregard for the court’s directives. “He announced he had dismissed me and led a group into the offices despite a court order,” Kanyi said, confirming he had reported the incident to the authorities.

The insurer, once dominant in the PSV insurance market with a 61.56% share in 2023, has seen its fortunes dwindle amid ongoing shareholder battles.

Its market share dropped to 35.67% by March 2025, overtaken for the first time by Africa Merchant Assurance (Amaco), which now holds 54.71%—a sharp rise attributed to Directline’s instability.

The situation follows previous controversy, including a Sh400 million withdrawal by Mr Macharia in early 2024, secretly funnelled to his real estate firm. The transaction was later overturned by court order.

Despite Directline’s insistence that “it is business as usual,” the ongoing legal dispute continues to raise serious questions about its credibility, market position, and regulatory standing.

Leave a Reply